Imagine you had a crystal ball that told you exactly how much a potential new customer would spend on your products and how long they’d keep buying from you.

With that information, you could build the perfect customer acquisition strategy, spending just enough to get them onboard while ensuring they become profitable, fast.

And you’d know whether it makes sense to chuck a bunch of perks—free shipping, free gifts, big discounts—their way, or whether it’ll end up costing you more than you can recoup.

Turns out that crystal ball (kind of) exists: it’s called customer lifetime value (CLV).

In this article, I’m going to define customer lifetime value, explain why it’s so important (and how to calculate it), then provide some tried-and-trusted tactics for increasing your CLV—backed up with real-world examples.

What is CLV?

Customer lifetime value (or CLV) stands for the total revenue a business earns from a single customer, from their first to final purchase.

The longer they stick with you and the more they spend along the way, the higher their CLV will be. And the higher your average CLV, the more you can afford to spend on acquisition and retention, helping you grow your customer base and generate even more revenue.

It’s a virtuous circle.

Why You Should Care About CLV

The most valuable ecommerce metrics are those that speak to what’s really going on with your business.

Sure, you want revenue to go up and to the right. But simply knowing your revenue figure doesn’t offer any deeper insights into customer behavior or the effectiveness of your marketing campaigns.

CLV, on the other hand, is extremely valuable because it helps you gauge the impact of everything from your approach to acquisition to your customer support, segmentation, and retention strategies.

Specifically, analyzing the lifetime value of a customer helps you…

Control Acquisition Costs

According to Startup Talky, the average customer acquisition cost (CAC) for retail brands stands at $10.

Of course, CACs will vary widely depending on your vertical and target audience. If you sell luxury handbags, you’d expect to spend more on acquisition than a toothpaste brand.

But what does a “good” (i.e. sustainable) CAC look like for your ecommerce business?

The best way to answer that question is to look at your customer lifetime value. On a basic level, if you spend $10 acquiring a customer, your CLV needs to be high enough to recoup the initial outlay and leave you in profit once you’ve deducted your operating costs.

Boost Loyalty & Retention

A low customer lifetime value is a sure sign that something’s wrong with your business.

Often, it all boils down to loyalty and retention: you’re not doing enough to turn new customers into repeat buyers. Perhaps your customer support isn’t up to scratch; maybe your messaging isn’t coaxing people back to your store; perhaps customers don’t feel incentivized to keep shopping with you.

Whatever the case, once you know you’ve got a CLV problem, you can dig deeper to find the root cause.

Target the Right Customers

Understanding your average CLV is obviously useful. But the real value comes from segmenting your CLV, helping you better understand the traits of your most loyal, highest-spending customers.

For instance, say your biggest spenders shell out $500+ throughout their relationship with your brand, whereas your lowest spenders only pay $50.

Armed with that information, you can dig into the traits of those two customer segments. How old are they? Which channel did you acquire them through? What was their first purchase?

Having built a clear picture of what your best customers look like, you can go out and target more people like them (and fewer who match the criteria of your lowest spenders).

How to Calculate Lifetime Value

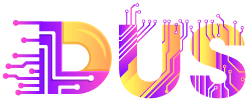

The basic customer lifetime value formula looks like this:

But before you can answer the question “what is the lifetime value of a customer?”, you need to do a little more number-crunching. Specifically, you need to calculate four separate metrics:

1. Average Order Value

First, define the time period you’re analyzing. Last year? Last quarter? Last month? Then use the following formula:

So, for example, if you earned $10,000 in a month from 50 orders, your formula would look like this:

Your average order value, in this case, would be $200.

2. Average Purchase Frequency

Next, calculate how often your average customer buys from you with this formula:

So let’s say, in 1 year, you get 600 orders. Those 600 orders came from 400 customers. That means your average purchase frequency rate would look like this:

3. Customer Value

Using the preview two metrics, you can calculate your customer value within a given period using this formula:

So, using the same example, it would look like this:

This ultimately means that each customer is worth $300 per year that they shop with you.

4. Average Customer Lifespan

Having gathered all those numbers, you can calculate the final element of the customer lifetime value equation: average customer lifespan, or the number of years a typical customer keeps buying from you.

So let’s say that you have 400 customers in a year, with their various lifespans which work out to about 2000 years when added all together:

Clearly, not every customer will be exactly the same. You might have some lifespans that last 2, 4, 7, and 10 years. But on average, you can expect a customer to stay loyal to your brand and purchase at least 1.5 times over a year.

5. Customer Lifetime Value

Now we have all of the information we need:

- Average order value: $200

- Average purchase frequency: 1.5

- Customer value: $300

- Average customer lifetime value: 5 years

Using the formula for customer lifetime value:

Now we plug what we know into our formula to calculate CLV:

This means, for each customer you earn, you can expect $1500 from them over their time with your brand.

How to Increase CLV

Now that you’ve calculated your customer lifetime value, you can start taking steps to increase it. Because whatever your current figure is, higher is always better.

Use these strategies to boost your CLV:

1. Start With Segmentation

Right off the bat, you can segment your email list by current CLVs.

Even though your CLVs will change (hopefully for the better), segmenting by CLV right now gives you a bird’s eye view of where you are.

It also allows you to focus on segments with lower CLVs. In effect, you’re creating a spectrum, from mostly inactive subscribers to loyal repeat customers.

The goal here isn’t to just focus on the customers who are buying from you. You have to look holistically at the entire range of CLVs across your entire email list.

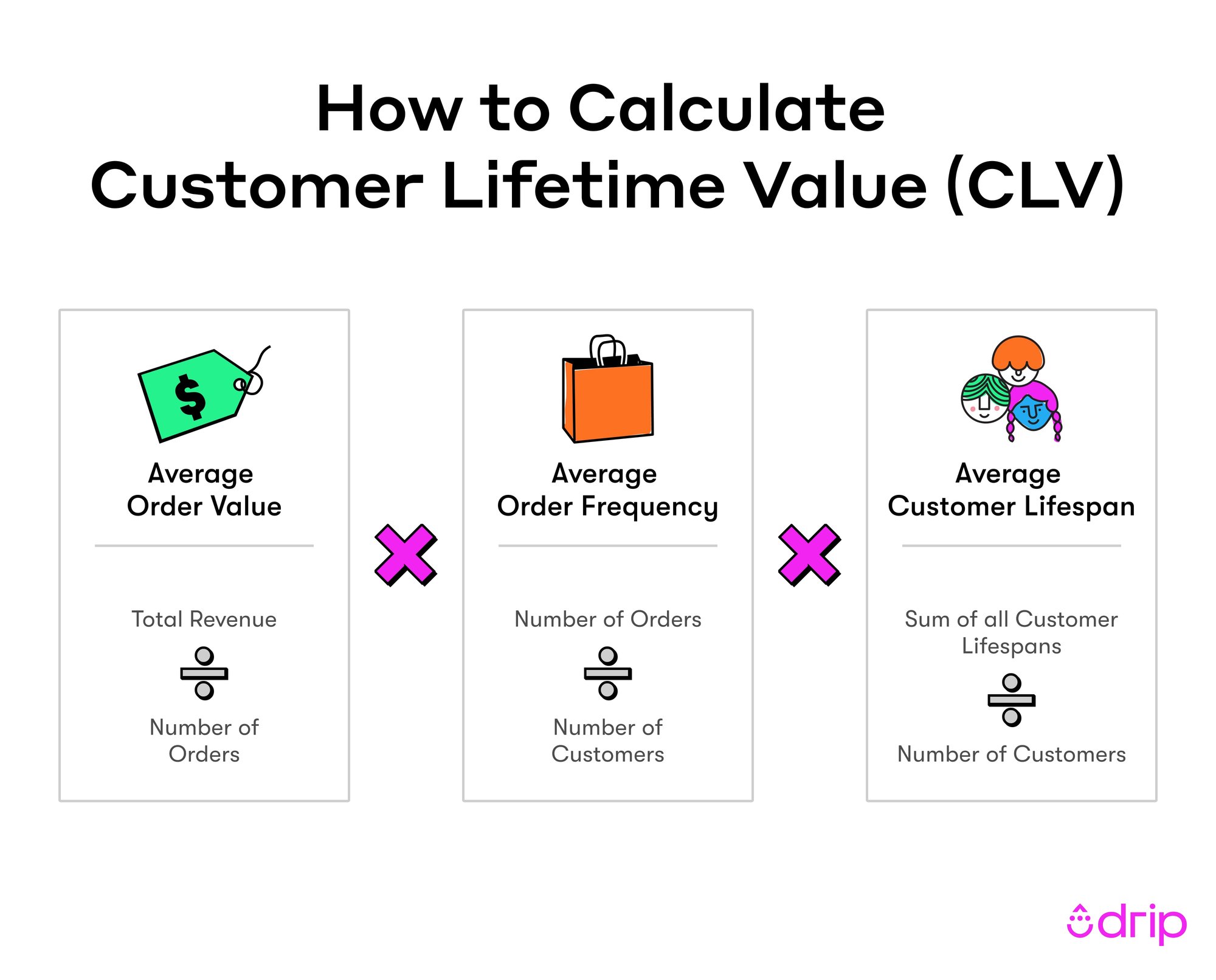

If you’re like most brands, you’ll find that there are usually two smaller groups of subscribers: the very unprofitable and the very profitable. The biggest group is usually made up of profitable subscribers.

That’s what a typical CLV curve will look like.

You can use this three-group curve as a guideline and segment your email list into three distinct parts.

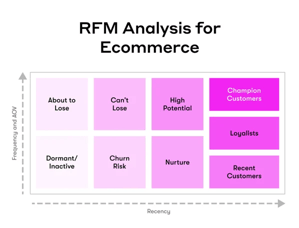

In fact, CLV is ultimately the basis behind your typical RFM Analysis (Recency, Frequency, and Monetary). This kind of analysis is a way that you separate your customers into groups based on how recently they’ve purchased, how frequently they purchase, and how much they spend. It’s basically a short-term view on CLV.

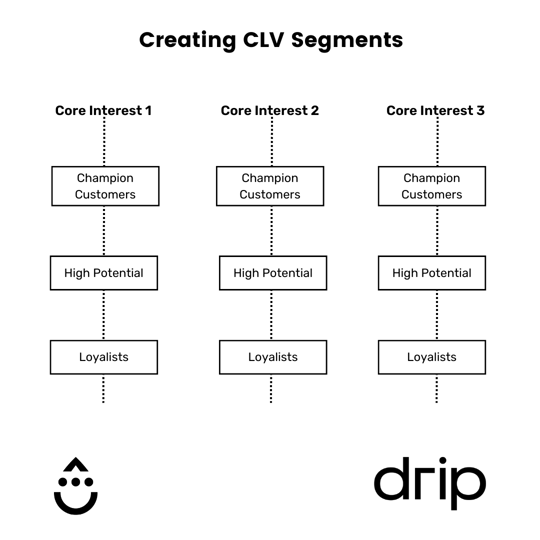

You can even segment your segments by CLV. I know that sounds confusing, but bear with me.

This technique allows you to create main segments based on another metric and then create groups from that segment.

Let’s see how this would play out in a real-world scenario.

Say you have a site that appeals to a wide range of people, maybe a food site. You could segment your list by category, so you’d have segments like health nuts, parents, and culinary enthusiasts.

You could take each interest group and then further segment it by CLV. This is a hyper-targeted approach to CLV segmentation, and it gives you a super detailed look at what’s going on.

No matter how you go about it, there’s no doubt that segmenting your email list like this will give you a solid foundation for increasing your CLV.

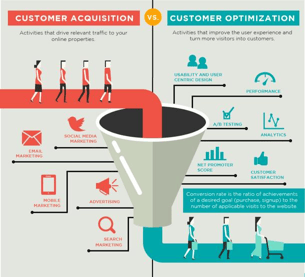

2. Focus Equally on Acquisition, Optimization, and Retention

In terms of increasing CLV, you should have three main goals.

To understand these three goals, let’s revisit the idea of three main groups: the unprofitable, profitable, and very profitable.

- Goal #1 should be to get new customers on your list with the aim of moving every subscriber from the unprofitable group into one of the profitable ones. In other words, you want to acquire new subscribers.

- Goal #2 should be to keep the profitable and very profitable groups stable. You probably recognize this concept as retention.

- Goal #3 should be to move customers from the unprofitable group into the profitable group. (You can also focus on moving customers from the profitable group to the very profitable group.)

These three goals are equally important. Lots of marketers tend to focus on just one or two of these three, and as a result, their whole email marketing strategy (and CLV) suffers.

In simple terms, you need to focus on customer acquisition and optimization/retention.

Goal #1 is all about acquisition, while Goals #2 and #3 fall squarely into the categories of optimization and retention.

To be clear, optimization and retention can (and often should) happen at the same time. The better you make the customer experience, the more people will stay loyal to your brand.

Acquire the Right Customers

So first, let’s talk acquisition.

It might seem a little strange to say that acquisition can increase your CLV. After all, aren’t the optimization and retention stages where the CLV enhancement happens?

Well, that’s what a lot of marketers think, and it’s really just a good way to shoot yourself in the foot.

I’m talking about having the right kind of acquisition. If your acquisition strategies aren’t optimal, you’ll build your entire email list on a shaky foundation.

That’s just one of the many reasons why having a rock-solid onboarding strategy can help increase your CLV.

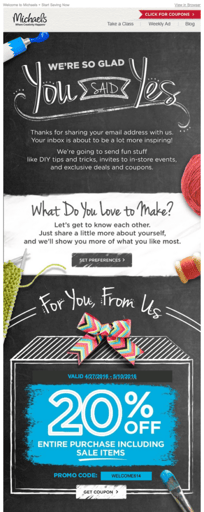

Focus on the welcome email for a minute. Your welcome email (or series of emails) is a new subscriber’s first impression of what it’s like to be on your list.

If you hit it out of the park like Michaels, you’ll impress your new signups and start a fantastic brand-customer relationship.

But if your welcome email doesn’t wow, you’ll probably experience a lower overall CLV.

It makes sense—first impressions matter. How you view a brand on day one can affect how much you spend on that brand.

There’s a lot more to the simple welcome email than you think.

According to Experian, welcome emails have transaction rates that are nine times higher than mass emails.

If you put a little effort into crafting the perfect welcome email, you can reap the rewards. (Oh, and the right onboarding email(s) can decrease churn as well, as this case study proves.)

Optimize Your Marketing

Now onto optimization.

When it comes to optimizing email marketing, it’s all about sending the right message to the right people at the right time.

You’ve probably heard me say that before, and it’s truer today than ever before. If you want to cut through all of the noise, you have to stand out.

Think about it: your average customer might get anywhere from 10 to 100 emails a day. No matter where on that spectrum you are, you need to give your subscribers reasons to open your emails (and stay on your list).

Sometimes, that means improving your subject lines.

Email optimization is a field of study all its own. The best way to optimize is to find what works for you.

Yes, it takes a lot of trial and error, but when you finally discover the perfect email marketing formula for your brand, it’ll be smooth sailing.

Take a Long-Term View on Retention

Once you’ve found what works, you can’t just quit, and that’s where customer retention strategies come into play.

Someone who’s been on your list for months needs to be just as engaged as the person who just signed up. If you put all your focus and energy into acquisition, you’ll experience a high amount of churn.

Retention isn’t just keeping customers around by whatever means necessary. Retention is the practice of keeping the user experience awesome throughout a customer’s time with your brand.

This is one of the big “secrets” of increasing CLV. Even though keeping your customers happy is something everyone tries to do, few marketers actually follow through with satisfying every kind of customer on their lists.

Retention is a long-term strategy, and you need to be prepared for it. It requires a multifaceted approach that looks at the relationship between you and your customers.

Don’t forget that acquisition, optimization, and retention are all pieces of the puzzle here. So don’t get so caught up in impressing new subscribers that you fail to please old ones.

3. Get Specific (and Personal) With Your Campaigns

You’ve probably heard that personalization is all the rage in email marketing, but I’ll get to that in a moment.

First, I want to talk about the power of specific campaigns.

Picture a typical product launch. Along with every launch comes a series of emails promoting the product, and these usually convert pretty well.

These emails have one distinct purpose: to share the news about the product.

Now imagine taking that kind of thought-out purpose and applying that to every email campaign you send. Ever.

Yes, it can be done, and yes, it works just as well as you think.

Some emails seem to have no purpose.

Sometimes, the worst emails aren’t bad, just boring.

An email can tick all the boxes and seem great in theory but fail miserably once it’s out in the real world.

To battle this, you need to make sure every email you send has a specific purpose.

Your emails don’t have to be revolutionary. They just need to do something.

Maybe you’re having a fire sale. Maybe you want to send an update on how your app is coming along.

As long as there is a point, your emails will be strong.

However, you don’t always need a big occasion to send an email. Sometimes, keeping the customer connected to your brand is the whole point.

This email from Birchbox demonstrates that concept beautifully:

The email is nothing more than a way of saying, “Hey, we haven’t forgotten about you!” It reminds the subscriber that you’re not just some faceless corporate brand.

Emails like this may seem pointless in comparison to product launch emails or welcome emails, but they’re just as important. Don’t overlook the small emails in favor of the big ones, even though it’s tempting to do so.

Whether the email has a big purpose or a small one doesn’t matter. It’s all about having a purpose in the first place.

If you send an email that doesn’t have any purpose (other than to expose your brand to your list and hope some of them convert), then that email probably won’t perform so well.

When you do email marketing for email marketing’s sake, your customers can smell it from a mile away. So don’t offend them by sending pointless emails.

Before you send any email, you need to ask yourself, “What’s the point?” If you can’t answer that question in one sentence, think twice about sending the email.

This requires you to be honest with yourself, and you’ll find that a lot of your emails have no point at all. That can kill your CLV and stop your progress dead in its tracks.

But if you follow through with this, your emails will be a heck of a lot better, and you’ll see your CLV go up, up, and away.

4. Build a Referral Program

Your existing customers are one of your most useful assets in your bid to increase CLV.

Let me explain:

Researchers from Frankfurt’s Goethe University and the Wharton School of the University of Pennsylvania carried out a 33-month study into nearly 10,000 new customers at a German bank. They discovered that when customers were referred by other customers, they generated a higher CLV (as well as higher profit margins and greater loyalty).

So if you can build a consistent pipeline of referrals, you can expect your customer lifetime value to grow. And the best way to build that pipeline is to launch your own referral program.

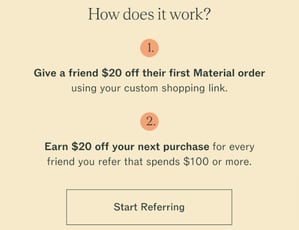

Kitchenware brand Material clearly understands this. It created a referral program in which both the referred customer and the referrer are rewarded with a $20 discount:

To avoid any confusion, Material also spelled out the terms of its referral program within the body copy, before closing with an action-oriented CTA:

5. Promote Post-Purchase Cross-Sells

Cast your eyes back to the customer lifetime value formula we showed you earlier, and you’ll realize that increasing CLV involves boosting customer value and/or lifespan.

To increase customer value, you’ve either got to persuade customers to buy more frequently or choose more expensive products.

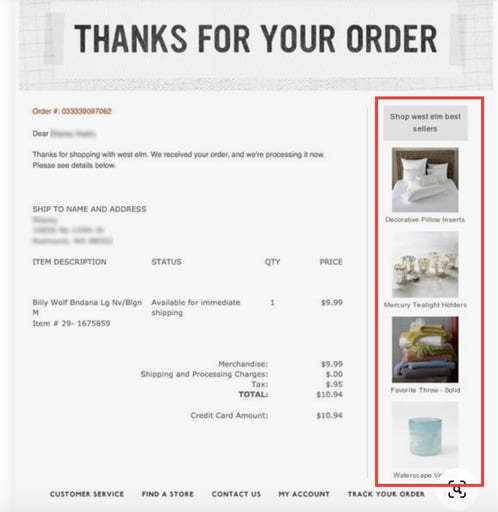

One of the most effective ways to elevate your average purchase frequency is through sending post-purchase cross-sell emails, like this one from furniture and interior decor brand West Elm:

For my money, the smartest element of this strategy is the way it uses order confirmations to drive cross-sells.

These transactional emails see much higher open rates — more than any other automated email format — so there’s a strong chance customers will see your cross-sell messaging.

6. Start a Loyalty Program

Okay, so post-purchase cross-sells can speed up your average purchase frequency. Now for the second element of increasing customer value (and, by extension, CLV): average customer lifespan.

Clearly, if you can persuade customers to stick with you for longer, you stand to generate more revenue from them, resulting in a higher CLV.

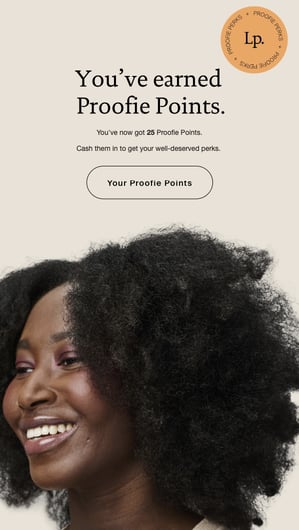

One way to increase customer lifespan is to launch a loyalty program. According to McKinsey, the best-performing loyalty programs can boost revenue from points-redeeming customers to the tune of 15 – 25 percent annually.

Haircare brand Living Proof evidently recognizes the benefits of a compelling loyalty program. It regularly updates customers on their points balances and teases the “well-deserved perks” they can enjoy:

Increase Customer Lifetime Value With Drip

As you can see, increasing CLV is all about segmenting your audience and delivering personalized campaigns that keep customers engaged (and spending).

That’s why you need Drip.

Our powerful, dynamic segmentation functionality combines data from your email campaigns, onsite activity, integrations, and store actions to connect the dots in your customer journeys.

Want to reward your most valuable customers, or build a winback campaign targeting high spenders at risk of churning? Drip makes it quick, easy, and code-free.

But don’t just take my word for it. See for yourself by signing up for your 14-day free trial.

Source link

[ad_3]

[ad_4]